Deconstructing a $1.5 Million Net Worth of Marisa Zanuck’s

Estimated Net Worth: $1.5 Million

Wealth Composition: Liquid Assets, Real Estate Equity, Investment Portfolio, Tangible Assets (Jewelry, Art)

Primary Value Drivers: Luxury Real Estate Commissions, Strategic Brand Equity, Capital Events (Divorce Settlement)

Profession: Luxury Real Estate Advisor (Formerly Agent), Television Personality, Brand Ambassador

Archetype: The Legacy-Adjacent Entrepreneur—building independent financial capital from proximity to dynastic wealth.

Marisa Zanuck’s estimated $1.5 million net worth is a sophisticated study in asset transformation. It represents the calculated conversion of social capital, a storied surname, and fleeting television exposure into a durable, self-made financial portfolio. Her financial standing is not an inheritance but an entrepreneurial construct, built primarily on the high-stakes commission structure of Beverly Hills real estate and sharpened by the branding power of reality television. Unlike many for whom reality TV is the career, for Zanuck, it was a strategic marketing campaign for her true enterprise: brokering trust and ultra-high-value properties among the elite. Her journey from wife of a Hollywood scion to an independent economic actor illustrates a modern blueprint for building wealth adjacent to, but distinct from, dynastic fortune.

The Engine Room: Deeper Dynamics of Luxury Real Estate Income

To understand Zanuck’s wealth is to understand the complex economics of top-tier real estate brokerage. Her role transcends mere “sales”; she operates as a fiduciary, consultant, and discreet negotiator for a clientele for whom privacy is paramount.

- Commission Mechanics & Brokerage Hierarchies: The standard commission model—a 5% total fee split between listing and buying brokerages—belies a complex flow of capital. For an agent at a firm like Hilton & Hyland or The Agency, the split with the brokerage is rarely 50/50. Top-producing agents with a strong personal brand, like Zanuck, can negotiate splits as favorable as 80/20 or even 90/10 in their favor, particularly after moving firms. Therefore, on a $10 million sale, the total commission is $500,000. If she represented the buyer and had an 80% split with her brokerage, her gross commission before taxes would be $200,000. Closing two to three such deals per year, a realistic volume for a well-connected agent, generates a high six-figure income that forms the bedrock of her net worth.

- The “Whisper Listing” Economy: A significant portion of business at this level never hits the public Multiple Listing Service (MLS). These are “off-market” or “pocket listings,” traded exclusively within networks of elite brokers and their wealthy clients. Access to this opaque market is the true marker of an agent’s influence. Zanuck’s affiliation with top boutiques and, crucially, her social pedigree, grant her entry into this realm. These deals often involve less competition and more discreet, higher-margin negotiations, enhancing her earning potential.

- The “RHOBH” as a Lead Generation Platform: Her appearance on the show was a masterstroke of targeted customer acquisition. It was not for a general audience but for a specific demographic: affluent viewers interested in the lifestyle the show portrays. By presenting herself as poised, professional, and tasteful amidst the drama, she effectively pre-vetted herself for potential clients who value discretion and sophistication. This is a form of marketing that is virtually impossible to buy with traditional advertising.

The Value of the Zanuck Surname: Social Capital as a Financial Instrument

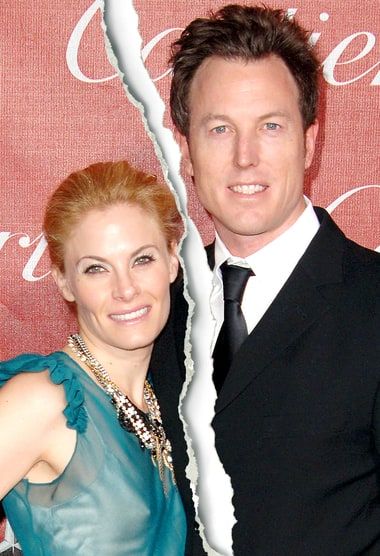

Her marriage to Dean Zanuck was far more than a personal relationship; it was an immersion into a stratum of Hollywood where social capital is a direct currency.

- Network Access and Trust Acceleration: The Zanuck name is a seal of legitimacy in entertainment and old-money Los Angeles circles. Being “vouched for” by virtue of her former association with such a dynasty drastically shortened the lengthy process of building trust with high-net-worth individuals. A referral from within the Zanuck network is worth infinitely more than a cold call.

- The Divorce Settlement: A Capital Reallocation Event: The dissolution of her marriage was not just an emotional separation but a critical financial recalibration. The sale of their marital home in 2016 for a $490,000 profit provided a public, quantifiable injection of capital. However, the full settlement almost certainly

involved the division of other marital assets, potentially including:

- Investment Portfolios: Stocks, bonds, and other securities acquired during the marriage.

- Retirement Accounts: Division of 401(k)s or IRAs.

- Tangible Assets: Division of high-value personal property such as art, jewelry, or vehicles.

This event provided her with the significant liquid capital necessary to invest, save, and operate independently outside the cash flow of her commissions.

Asset Allocation and Portfolio Construction

A net worth of $1.5 million suggests a diversified portfolio beyond a checking account. Its composition likely includes:

- Liquid Reserves: A substantial cash buffer held in high-yield savings or money market accounts to cover expenses between large, irregular commission checks. This provides stability in a commission-based career.

- Retirement and Investment Accounts: A professionally managed portfolio of stocks, bonds, and exchange-traded funds (ETFs) within tax-advantaged accounts like an IRA or a Solo 401(k) (common for independent contractors like realtors).

- Real Estate Equity: While she sold the marital home, it is plausible she has since invested in a personal residence or investment property, building equity separate from her business.

- Tangible Assets: High-value personal effects—designer handbags, jewelry, art—acquired during her marriage and through her own success. While illiquid, these items hold significant value and act as a store of wealth.

The Intangible Asset: Brand Equity

- Expertise: Proven success in luxury real estate.

- Association: The enduring cachet of the Zanuck name.

- Exposure: National recognition from RHOBH.

- Aesthetic: A public persona of taste and discretion.

This brand equity allows her to command higher commission splits, secure exclusive listings, and attract clients who are buying into her perceived lifestyle and expertise as much as they are buying a property. It is the engine that drives all her revenue streams.

Strategic Financial Management and Risk Mitigation

Building and maintaining wealth at this level requires astute financial management, particularly when income is variable. Zanuck’s strategies likely include:

- Aggressive Tax Planning: As an independent contractor, her entire tax burden—including the self-employment tax—falls on her. This necessitates meticulous accounting to maximize business expense deductions (e.g., marketing costs, car leases for client tours, professional dues, and a home office) and strategically time income. Employing a skilled CPA is not an option but a necessity to protect her earnings.

- Cyclical Market Hedging: The Los Angeles luxury real estate market is susceptible to economic booms and busts. A savvy agent must plan for downturns. Her liquid reserves act as a personal safety net. Furthermore, her diversified investment portfolio, ideally containing bonds and dividend-paying stocks, provides passive income streams that are uncorrelated to the housing market, ensuring financial stability during slower sales periods.

- Lifestyle Arbitrage: A key to growing net worth is controlling outflow. While she operates in a world of extreme wealth, residing in Los Angeles rather than a more prohibitively expensive city like New York allows for a high standard of living while still accumulating capital. Avoiding the trap of “performing” wealth for clients—by maintaining a sophisticated but not ostentatious personal presentation—is crucial for long-term financial health.

In conclusion, Marisa Zanuck’s net worth is not a static number but the current valuation of a dynamic personal enterprise. It is the product of a decade-long strategy of leveraging every available asset—a powerful name, a television platform, and formidable personal drive—to build a independent, self-sustaining financial foundation firmly within the world of luxury real estate. She exemplifies how perceived “secondary” characters in grand narratives can skillfully write their own economic success stories through strategic positioning, financial discipline, and the masterful conversion of influence into tangible equity.