A Comprehensive Analysis of Dianne Feinstein’s $110 Million Net Worth

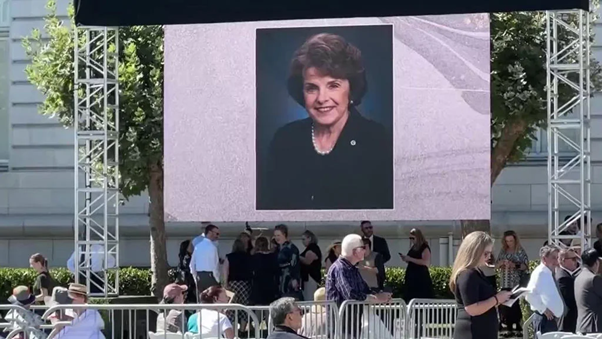

Dianne Feinstein’s passing in September 2023 marked not just the end of an extraordinary political career spanning more than five decades, but also the conclusion of a remarkable financial journey that paralleled her rise to power. As San Francisco’s first female mayor and California’s longest-serving U.S. senator, Feinstein broke numerous glass ceilings in American politics. Feinstein stood as one of the wealthiest individuals ever to serve in Congress, with an estimated net worth of $110 million at the time of her death. This colossal fortune, accumulated through strategic real estate investments, a powerful marital partnership, and sophisticated wealth management strategies, presents a fascinating case study in how political influence and private wealth intersect in modern America. Her financial story reveals not just the accumulation of wealth, but the complex architecture of maintaining and growing substantial assets while serving in public office.

Deconstructing a $110 Million Empire: The Architecture of Feinstein’s Wealth

The composition of Feinstein’s fortune reveals a sophisticated approach to wealth management that extended far beyond typical congressional investment patterns. Her portfolio demonstrated a preference for tangible assets, private equity positions, and geographically diversified holdings that provided both capital appreciation and substantial passive income streams.

The Foundation: Carlton Hotel Properties Stake

The cornerstone of Feinstein’s financial empire was her substantial ownership position in Carlton Hotel Properties, valued at approximately $50 million. This investment represented far more than a simple stock holding—it constituted a significant private equity stake in a company controlling valuable real estate assets, most notably San Francisco’s historic Hotel Carlton (currently operating as the Joya Hotel). This investment strategy provided multiple wealth-building advantages: it offered exposure to San Francisco’s notoriously expensive real estate market without direct property management responsibilities, generated consistent revenue through hotel operations, and provided potential tax benefits through depreciation and business expense deductions. The illiquid nature of such private investments typically requires long-term commitment but can yield superior returns compared to public market equivalents, suggesting a strategic patience in Feinstein’s approach to wealth accumulation.

Strategic Real Estate Portfolio Development

Feinstein and her husband Richard Blum employed a sophisticated real estate investment strategy that combined identification of undervalued properties, value-added development, and strategic disposition timing. Their approach demonstrated particular expertise in luxury market dynamics and regulatory environments across multiple jurisdictions:

Aspen Transformation: From Raw Land to Luxury Retreat

Their 1996 acquisition of 36 acres of undeveloped land for $1.975 million represented a bet on both the continued appreciation of Aspen real estate and their ability to navigate complex mountain construction regulations. The subsequent development of a 9,000-square-foot luxury residence with five bedrooms and premium amenities transformed the raw land into a high-value asset. The March 2023 sale for $25 million—occurring amid a booming luxury real estate market—demonstrated impeccable timing and generated an estimated twenty-fold return on their initial investment when accounting for development costs.

Lake Tahoe Waterfront Appreciation Play

Their Lake Tahoe transaction showcased even greater financial sophistication. The 2007 purchase of a 4.75-acre waterfront compound for $9.7 million occurred just before the Great Recession temporarily depressed luxury real estate values. Their holding period through the market recovery and subsequent boom during the COVID-19 pandemic, when wealthy buyers sought spacious secondary homes, positioned them perfectly for their 2021 sale. While their initial $46 million asking price proved ambitious, the final $33 million sale price still represented a 240% return over fourteen years—approximately 9% annualized appreciation, significantly outperforming most traditional investments.

Additional Strategic Holdings

Their real estate portfolio further included a Pacific Heights mansion purchased for $16.5 million in 2006, representing a bet on San Francisco’s perpetual status as a premium real estate market; a Washington D.C. residence in the exclusive Spring Valley neighborhood, providing both practical lodging during congressional sessions and exposure to the stable D.C. real estate market. Each property served specific strategic purposes within their overall wealth preservation and growth strategy.

Liquid Assets and Investment Portfolio Construction

Beyond real estate, Feinstein maintained substantial liquid resources positioned across carefully selected asset classes. Her $5-25 million holding at First Republic Bank—a institution specializing in high-net-worth clients—provided both exceptional service and financial flexibility. Her investment portfolio appeared constructed according to modern portfolio theory principles, with diversification across large-cap equities, government securities, and likely alternative investments not requiring disclosure. This balanced approach provided stability during market downturns while participating in equity market appreciation.

The Power Couple Dynamic: Richard Blum’s Financial Acumen

Richard Blum’s career as founder of Blum Capital Partners, a private equity firm with historically strong returns, provided the couple with investment expertise unavailable to most individuals. His background in leveraged buyouts and value investing undoubtedly influenced their approach to real estate—viewing properties not just as homes but as potential value-creation opportunities through strategic improvements and optimal timing.

Blum’s financial network provided access to exclusive investment opportunities, premium financial advice, and favorable banking relationships. His understanding of complex financial structures, tax optimization strategies, and risk management techniques would have been instrumental in growing and protecting their combined wealth. The couple’s ability to separate political decision-making from investment management—despite potential ethical questions—demonstrated sophisticated compartmentalization that allowed Feinstein to maintain her public image while benefiting from Blum’s financial strategies.

Government Service Compensation in Context

Feinstein’s $174,000 annual Senate salary represented less than 0.2% of her total net worth, making her essentially financially independent from her government position. This independence arguably provided political freedom but also created potential perception challenges regarding representation of average constituents. Her financial disclosure reports, required of all senators, provided transparency but also highlighted the vast wealth disparity between many lawmakers and those they represent.

Philanthropic Distribution and Legacy Building

Through the Blum Family Foundation, the couple engaged in strategic philanthropy that mirrored their personal interests and investment approaches. Their giving focused on measurable impact in specific areas: Himalayan development projects reflected Blum’s personal connection to the region, while medical research donations to UCSF aligned with both Feinstein’s policy interests and potential legacy building. Their philanthropic approach appeared more strategic than sentimental, focusing on areas where their contributions could catalyze larger impacts rather than scattered charitable giving.

Wealth Preservation and Estate Planning Complexities

The disposition of multiple properties in the years preceding Feinstein’s death suggests sophisticated estate planning aimed at minimizing tax liabilities and simplifying wealth transfer. The timing of sales likely considered capital gains tax implications, step-up in basis considerations, and the complexities of distributing illiquid assets among heirs. The use of trusts, charitable foundations, and other wealth preservation strategies would have been essential components of managing an estate of this complexity.

Conclusion: The Dual Legacy of Public Service and Private Wealth

Dianne Feinstein’s financial narrative presents a complex portrait of modern American wealth and power. Her $110 million fortune was not accumulated through corruption or exploitation but through sophisticated investment strategies, advantageous marriage, and long-term capital appreciation. Yet it creates a fascinating dichotomy: a career public servant who simultaneously operated as a sophisticated wealth accumulator in premium real estate markets and private investments.

Her story reflects broader patterns of wealth concentration among governing elites and raises questions about representation when lawmakers’ financial experiences differ so dramatically from their constituents. At the same time, it demonstrates how wealth building through conventional investment channels remains possible even while maintaining demanding public responsibilities.

Feinstein’s legacy thus exists in two parallel dimensions: the public record of legislative achievements and political firsts, and the private financial success that enabled her to operate from a position of extraordinary independence. Both aspects contribute to understanding her complete impact on American society—as both a shaper of policy and a participant in the nation’s economic architecture. Her story offers insights into the complex relationship between public service and private wealth in contemporary American democracy, providing a case study that will likely inform both political and financial analysis for years to come.