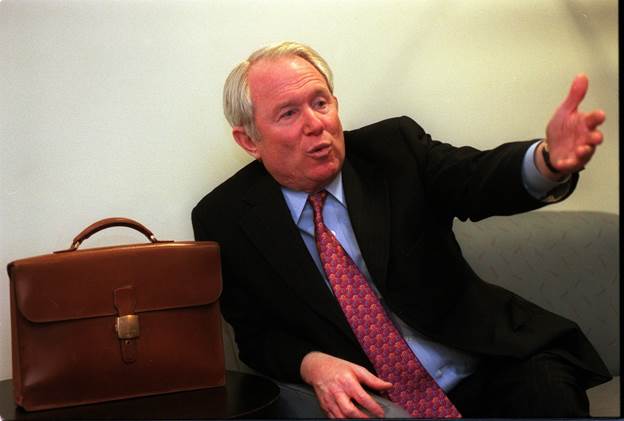

The world of real estate has produced many billionaires and multimillionaires, but only a few have reshaped the industry in such a transformative way as William Sanders. Known as a visionary investor and the “Warren Buffett of real estate,” Sanders built an empire that earned him both enormous wealth and respect in financial circles. By the time of his passing in 2017, his net worth was estimated at $600 million.

This article examines William Sanders’ journey—from his early life and education, to building real estate giants, to the financial strategies that enabled him to accumulate such extraordinary wealth. His story offers insights not only into personal achievement but also into the power of innovation in real estate investment.

Early Life and Education

William Sanders was born in Omaha, Nebraska, in 1931. Growing up in the heartland of America, Sanders was deeply influenced by values of hard work, frugality, and determination. Omaha itself would later become synonymous with financial legends, most famously Warren Buffett, with whom Sanders often drew comparisons.

He pursued higher education at the University of Illinois Urbana-Champaign, earning a degree in mechanical engineering. Later, he obtained an MBA from the University of Chicago Booth School of Business. His academic foundation provided him with the analytical skills and strategic thinking necessary to enter the highly competitive world of real estate investment.

First Steps in Real Estate

Sanders entered the real estate industry during the mid-20th century, a time when suburban development and commercial property were beginning to reshape the American economic landscape.

Unlike traditional real estate developers who focused solely on building properties, Sanders took an innovative approach: he emphasized investment structures, partnerships, and financial engineering. This meant he was not just a builder but also a strategist, someone who could bring together capital, investors, and development opportunities to maximize returns.

Founding LaSalle Partners

One of Sanders’ biggest contributions to the real estate industry was the founding of LaSalle Partners in 1968. The firm quickly became one of the most respected real estate investment management companies in the United States.

LaSalle Partners specialized in providing services such as property management, investment banking for real estate, and consulting. Sanders’ leadership turned the firm into a powerhouse, managing billions in assets for institutional investors.

In 1999, LaSalle Partners merged with Jones Lang Wootton, forming Jones Lang LaSalle (JLL)—today one of the largest real estate services firms in the world. This merger solidified Sanders’ reputation as a pioneer in global real estate investment.

The Rise of Security Capital Group

Perhaps Sanders’ most innovative project was the founding of Security Capital Group in the early 1990s. Headquartered in Santa Fe, New Mexico, this company became a game-changer in how real estate was financed and developed.

Security Capital acted as a holding company that invested in real estate operating companies, ranging from apartment complexes to storage facilities. Sanders developed a unique business model that emphasized REITs (Real Estate Investment Trusts), allowing investors to participate in real estate portfolios much like they would in stocks.

At its peak, Security Capital Group had stakes in companies that eventually evolved into major players, such as ProLogis (a leader in industrial real estate) and Archstone (a giant in apartment investments).

Wealth Accumulation and Net Worth

William Sanders’ estimated net worth of $600 million was built on decades of smart investments, entrepreneurial vision, and financial acumen. Let’s break down the key components of his wealth:

1. Real Estate Investment Trusts (REITs)

Sanders was one of the earliest champions of REITs, which became a cornerstone of his fortune.

His companies managed billions in real estate assets across commercial, residential, and industrial properties.

2. Security Capital Group

His ownership stake and leadership in Security Capital provided massive financial returns.

The company’s model allowed him to multiply wealth by controlling multiple REITs under one umbrella.

3. LaSalle Partners (Later JLL)

The growth and eventual merger of LaSalle Partners created long-term financial rewards.

JLL is now a Fortune 500 company with global influence.

4. Diversification and Private Investments

Sanders was known for his careful but bold investments in multiple property sectors.

His diversification strategy ensured steady returns and minimized risk.

Leadership Style and Business Philosophy

Sanders was often compared to Warren Buffett, not just because they both hailed from Omaha but also because of their shared philosophy: long-term value creation over short-term gains.

His approach to leadership was visionary yet disciplined. He was not a flashy businessman but a strategist who understood markets, timing, and capital structure. Sanders emphasized building sustainable enterprises rather than chasing quick profits.

Lifestyle and Personal Life

Despite his vast fortune, William Sanders lived a relatively private and modest life compared to many other real estate magnates. He was known to value family, integrity, and philanthropy over extravagant displays of wealth.

Sanders spent much of his later life in Santa Fe, New Mexico, where he enjoyed a quieter lifestyle, away from the fast-paced financial centers of New York or Chicago.

Philanthropy and Giving Back

Sanders was also recognized for his philanthropy. He contributed to educational institutions, community initiatives, and cultural organizations. His donations supported the University of Chicago and other institutions that helped nurture future business leaders.

His giving reflected a belief that wealth should be used not only for personal security but also for the betterment of society.

Legacy in the Real Estate World

William Sanders’ impact on the real estate industry cannot be overstated. His pioneering use of REITs and the creation of Security Capital Group transformed how institutional investors approached real estate.

Some of the companies he founded or nurtured remain leaders in their sectors today, providing proof of his enduring influence. His reputation as the “Warren Buffett of real estate” remains a testament to his vision and success.

Future Outlook of His Estate

Though Sanders passed away in 2017, his wealth and companies continue to generate returns for his family, partners, and investors. His estate’s value remains tied to the legacy of the enterprises he created, many of which still thrive today.

Companies like ProLogis, which Sanders helped shape, are global leaders worth billions, underscoring the lasting financial and strategic impact of his work.William Sanders’ $600 million net worth is not just a measure of personal wealth but also of innovation, foresight, and leadership in real estate. From founding LaSalle Partners to creating Security Capital Group, Sanders reshaped an entire industry and left a legacy that continues to benefit investors and institutions worldwide.

Unlike many who chase wealth for its own sake, Sanders built lasting value—companies that endure, systems that innovate, and opportunities that empower others. His story is a reminder that real wealth comes from vision, discipline, and the courage to pioneer new paths.

For future generations of real estate professionals, William Sanders remains a towering figure, a man whose influence stretched far beyond his $600 million fortune and into the very fabric of modern real estate investment.