In the modern world, where messages cross continents in seconds and meetings happen across time zones, it’s easy to assume that money moves just as fast. Yet, for many companies, international payments remain frustratingly slow and complicated.

Delays, unexpected fees, and confusing banking rules still make global transactions harder than they should be. The surprising part? Much of this difficulty doesn’t come from technology — it comes from misunderstandings about how global payments actually work.

Let’s clear the fog around some of the most common myths that continue to hold businesses back from moving money efficiently across borders.

The “It’s Always Slow” Mindset

For decades, sending money overseas meant waiting days for funds to arrive. Transfers bounced between banks and intermediaries, with each step adding time and taking a small slice of the total amount. Many business owners grew used to this rhythm and began to believe that slow payments were simply part of doing international business.

But times have changed. Digital payment systems now use direct, real-time networks that can move money from one country to another in a matter of minutes. Financial technology firms have built systems that skip the traditional layers of bureaucracy and connect banks directly or use local clearing channels.

In other words, the assumption that “it has to take days” is no longer true. The only thing slower than the old system is the belief that it’s still the only option.

Speed Doesn’t Mean Compromising Safety

Another common fear is that faster payments must be less secure. It sounds logical — after all, how can something happen instantly and still go through proper checks?

Yet, the reality is that speed and security can coexist. Today’s payment technology uses advanced encryption, fraud detection powered by artificial intelligence, and instant verification processes that actually make transactions safer than before. By cutting out unnecessary middlemen, there are fewer opportunities for errors or fraudulent activity to occur.

Modern cross-border payment systems don’t sacrifice caution for convenience; they combine both, allowing money to move swiftly while maintaining strict regulatory compliance.

The Myth of the Local Bank Account

Many businesses still think that to send or receive payments internationally, they need to open a local bank account in every country they deal with. That might have been true a decade ago, but technology has rewritten the rulebook.

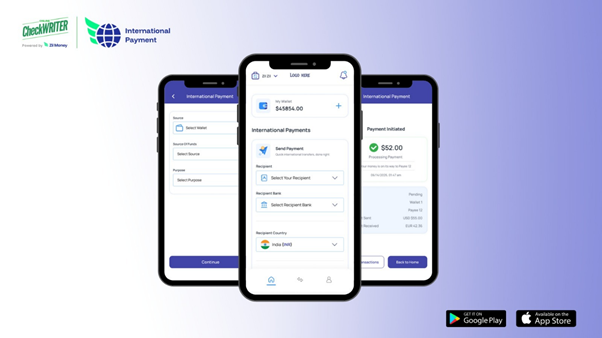

Now, multi-currency and virtual accounts allow companies to manage global transactions from one platform. Businesses can hold balances in several currencies, pay suppliers in their local money, and receive payments from clients abroad — all without the hassle of setting up multiple bank accounts.

This digital flexibility doesn’t just save time; it also saves money by reducing conversion fees and eliminating redundant administrative costs. What once required a network of local offices can now be done with a few clicks.

Banks Aren’t Always the Cheapest Option

Traditional banks still handle a large share of global transactions, but that doesn’t mean they offer the best deal. Many businesses assume that sticking with their usual bank ensures lower costs and smoother service. Unfortunately, that’s often not the case.

Banks frequently apply hidden exchange rate markups — small adjustments that add up to significant losses over time. A transaction that looks cheap on paper can end up costing several percentage points more once all fees are factored in.

Specialized payment providers and fintech platforms operate differently. They use local banking networks, match payments regionally, and often pass savings directly to customers. By rethinking how money flows, these providers can make international transfers faster, clearer, and more affordable.

In today’s financial landscape, loyalty to old systems can quietly drain profits. Choosing modern solutions doesn’t just save money; it reflects a smarter approach to global growth.

Global Speed Isn’t Just for the Giants

There’s a lingering belief that quick, cost-efficient international payments are reserved for large corporations. Smaller businesses and freelancers often assume they have to deal with the slow, expensive side of global banking because they lack scale or influence.

That’s no longer the case. Today’s digital financial platforms are designed for businesses of every size. A small startup, an independent consultant, or an e-commerce brand can all access fast cross-border payment tools that were once exclusive to multinational firms.

Whether it’s paying a designer overseas, sending funds to a supplier, or collecting payments from international clients, technology has made it possible for smaller companies to operate with the same speed and confidence as global enterprises. In this new landscape, agility often beats size.

Why These Misconceptions Still Exist

If the technology is already here, why do these outdated ideas still persist? Partly because financial habits change slowly. Many businesses learned to operate within a world where global payments took days or weeks, and the systems they used then have become part of their comfort zone.

There’s also the issue of trust. Traditional banks have long been seen as the safest hands for handling money, and change in this space requires confidence. Meanwhile, many banks haven’t done much to educate clients about faster, cheaper options — and in some cases, they benefit from keeping customers tied to older systems.

But as business becomes increasingly borderless, companies can no longer afford to ignore innovation. The real cost isn’t just in transfer fees — it’s in lost time, lost opportunities, and slower growth.

A Shift in Mindset

The real obstacle to faster global payments isn’t technology — it’s the mindset that clings to the past. Many firms continue using outdated systems not because they must, but because they don’t realize how much better it could be.

Adopting modern cross-border payment solutions doesn’t mean taking risks. It means embracing infrastructure that’s been built for a digital, connected world. Companies that shift their mindset discover smoother operations, improved cash flow, and stronger relationships with partners and suppliers around the globe.

Those that don’t may find themselves left behind, not because their competitors are bigger, but because they’re faster.

The Future of Global Payments

As global commerce evolves, speed will define success. Businesses that can move funds instantly will negotiate better deals, respond faster to opportunities, and maintain healthier cash cycles. The infrastructure is already here: real-time settlement networks, transparent currency conversion, and smart systems that learn and adapt.

What remains is for business leaders to let go of the old myths and step into a world where fast, secure international payments are no longer the exception — they’re the standard.

Money isn’t meant to wait in limbo. It’s meant to move, grow, and connect. And in this new era of global business, the companies that understand that truth will be the ones driving the future forward.