In a financial world dominated by complex algorithms, high-frequency trading, and tech disruptors, Warren Buffett stands as a testament to the enduring power of simplicity, patience, and principle. Known as the “Oracle of Omaha,” Buffett is not merely one of the world’s wealthiest individuals; he is perhaps its most revered investor. His journey is a masterclass in consistent, long-term value creation, proving that the most sophisticated strategy is often a deeply rational one. Unlike his flashier contemporaries, Buffett’s empire was built not on inventing new technologies, but on a profound understanding of business fundamentals and human behavior.

A Prodigy’s Prelude: The Early Hustle

Delivering newspapers as a boy, he deducted the $35 cost of his bicycle from his taxes. He purchased his first stock at age 11 and filed his first tax return at 13. By the time he graduated high school, he had already generated the equivalent of over $50,000 in today’s money from various enterprises, including owning and operating pinball machines. This early, hands-on experience with cash flow, reinvestment, and compound interest was the practical foundation upon which he would build his entire philosophy. He wasn’t just learning about investing; he was learning how businesses work from the ground up.

The Graham Doctrine and the Evolution of a Philosophy

Buffett’s intellectual framework was forged at Columbia Business School under the mentorship of Benjamin Graham, the father of value investing. Graham’s principle of hunting for “cigar butt” stocks—companies so undervalued they had one “puff” of profit left—was Buffett’s initial guide

However, Buffett’s genius was in evolving beyond this. With the influence of his partner, Charlie Munger, he shifted from seeking merely “cheap” companies to seeking “wonderful companies at a fair price.” This critical pivot moved his focus from statistically undervalued assets to high-quality businesses with durable competitive advantages, or “economic moats.” This moat could be a powerful brand (Coca-Cola), a dominant market position (See’s Candies), or a regulatory advantage (GEICO). This strategy was less about arithmetic and more about assessing the qualitative, long-term strength of a business.

Berkshire Hathaway: The Ultimate Conglomerate

The story of Berkshire Hathaway itself is a lesson in adaptability. Originally a struggling textile manufacturing company, Buffett began acquiring its shares in the 1960s because they appeared cheap. He later admitted this was a “monumentally stupid” decision, as he was pouring money into a dying industry. Rather than abandon it, he transformed Berkshire. He stopped the textile operations and used the company as a shell—a holding vehicle for his investments. He began using the float from insurance companies he acquired (like GEICO and National Indemnity) as capital to invest in other businesses. This created a powerful, self-funding engine: insurance premiums provided steady, upfront cash that could be deployed to buy other cash-generating businesses, whose profits could then fund more acquisitions.

A significant part of Buffett’s allure is the stark contrast between his immense wealth and his modest, down-to-earth lifestyle. . He is known for his love of Cherry Coke and McDonald’s breakfasts. This frugality is not an act; it is a fundamental part of his investing principle. He believes in letting capital compound, not in extravagant spending.

His annual shareholder letters are not dry financial reports; they are literary events, filled with wit, wisdom, and straightforward advice that resonates with novice investors and Wall Street titans alike.

The Fortune and the Future: A Pledge, Not a Hoard

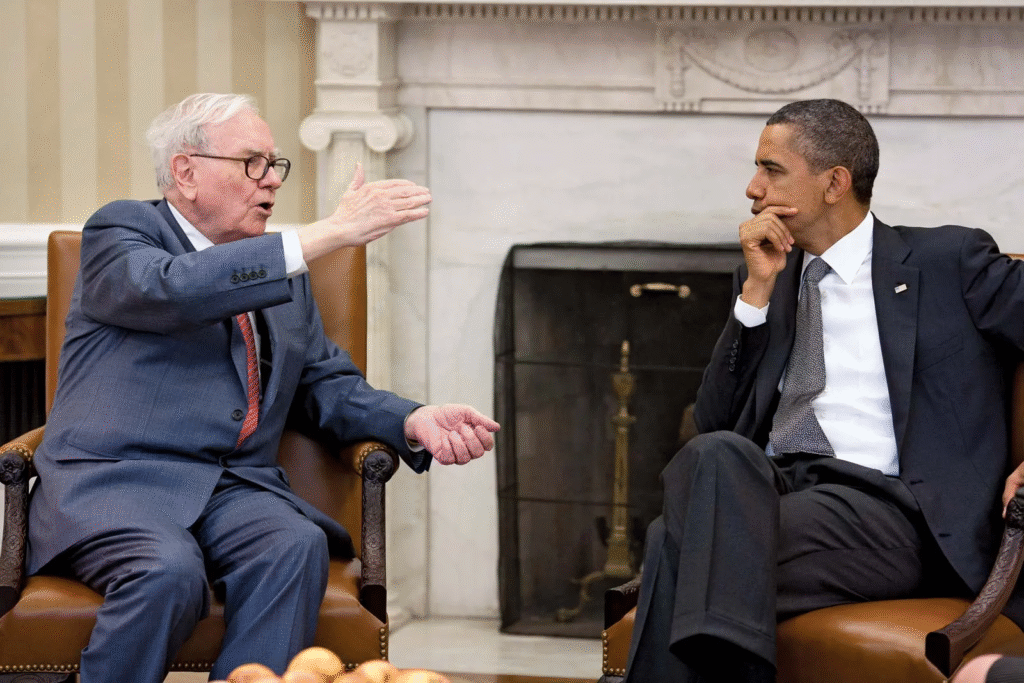

Warren Buffett’s net worth, estimated at over **$130 billion**, is almost entirely tied to his ownership of Berkshire Hathaway stock. His wealth is a direct function of his company’s performance over seven decades.

Perhaps his most profound legacy is his commitment to giving it all away. In 2006, he announced the largest philanthropic pledge in history, committing over 99% of his fortune to charity, primarily through the Bill & Melinda Gates Foundation. His “Giving Pledge” initiative encourages other billionaires to do the same. For Buffett, his wealth is not an heirloom to be hoarded but a responsibility to be returned to society, a final, powerful lesson in rational allocation.

Warren Buffett’s story is a reminder that in a world chasing the next big thing, there is immense power in clarity, rationality, and time.